A post dialogue meeting to the 6th edition of the Zimbabwe Alternative Mining Indaba (ZAMI) was held at the Meikles hotel on 07 November 2017. This was a jump start to a series of reflective conversations on ZAMI 2017 Action Agenda that will be jointly facilitated by ZAMI organizers to reach out to key government institutions, business players, Civil Society Organisations (CSO), media and communities. Primarily, the planned reflective conversations are meant drill down deeper on specific ZAMI Action Agenda items, to influence policy and practice reforms tailored to make mineral resources work for all Zimbabweans. A daunting challenge considering the recent resource curse that struck with discovery and subsequent exploitation of Marange diamonds. Roughly $15 billion was lost according to the President available here.

By Mukasiri Sibanda

- The national budget and the revenue performance reports produced by the Treasury and the Zimbabwe Revenue Authority (ZIMRA) should align with international best practice on mineral revenue transparency like the Extractive Industry Transparency Initiative (EITI) . This means that mineral revenue contribution to the national purse should be specifically disclosed under each revenue head like Corporate Income Tax (CIT), Pay As You Earn (PAYE), customs duty, withholding taxes and royalties among others.

This requirement is not too much to ask as data on payments made various government institutions by Caledonia’s Blanket Mine is available courtesy of Canadian Extractive Sectors Transparency Measures Act (ESTMA) report available here. A requirement under the Toronto Stock Exchange (TSX). Likewise, data on payments made to government by Anglo-American owned Unki mine is public accessible because of the EU mandatory disclosures for listed companies in the extractive sector. Further details on budget transparency available here and tax transparency available here.Melusi responded that MOF has the data on mining contribution per revenue head. However, there is need to review the current budget reporting framework to ensure public disclosure of mining contribution per revenue head. Further, Melusi utged CSOs to work with Zimbabwe National Statistics Office (Zimstat) on best practice pertain to government information disclosure. He also urged CSOs to make use of public pre-budget consultations to give their input on national budget. ZELA’s response was that it made written submissions on the 2018 budget public consultations through the Parliament Portfolio Committee on Mines and Energy and Parliament Portfolio Committee on Finance and Economic Development.

- To fulfil their mandate on Domestic Resource Mobilisation (DRM), both MOFED and ZIMRA should push for open contracts in Zimbabwe which mitigates the risks of corruption and poor mining deals available here. Open contracting in the minerals and mining sector is provided for under Section 315 subsection 2 (c). Melusi’s commented that MOFED and ZIMRA only implement the fiscal side of Mining Agreements (MAs). Multiple Ministries are involved in the negotiation of Mining agreements. Therefore, disclosure of MAs needs requires engagement with multi government MDAs.

- MOFED and ZIMRA should both disclose tax incentives which are off budget expenditures in nature and a cost to the national purse. This will allow the public to do a cost benefit analysis to sniff out harmful tax incentives and hold government and corporates to account on bad deals like stabilisation clauses. Basically, stabilisation clauses restrict government’s ability to flexibilise its tax rates to capture a fair share of revenue during community price booms. Melusi responded by saying the tax incentives given to investors are a matter of public record as detailed by the Income Tax Act (Chapter 23:06) and ZIMRA’s website available here. In response, ZELA explained that it refers to the actual amount of revenue forgone due to tax incentives. ZIMRA’s acting Commissioner General urged CSOs to engage ZIMSTAT on this issue. Tatenda Mombeyara of Trust Africa remarked that ZIMRA and MOFED should also raise issues discussed here with their counterparts in government like the ZIMSTAT.

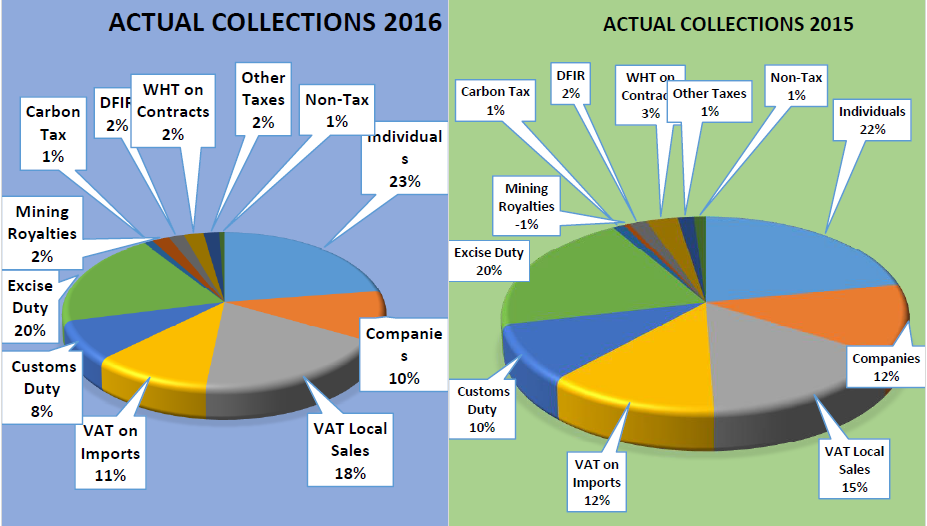

- On progressive tax regimes, Melusi and Kuzvinzwa explained that government has a progressive tax regime. A case in point involves PAYE, the more salary you earn the more taxes you pay. In addition, Kuzvinzwa asked for more conversation to understand what CSOs mean when they imply that they want government to adopt a progressive tax regime. Judith Kaulema of Poverty Reduction Forum Trust (PFRT) opined that whilst government’s taxes on paper are progressive, in practice this may not be the case. The ZAMI discussion during the Tax Justice session revealed that individuals were the highest tax contributors through VAT and PAYE whilst CIT contribution to the treasury is meagre.

Extracted from ZIMRA’s 2016 annual revenue performance report, available here

Extracted from ZIMRA’s 2016 annual revenue performance report, available here

- The 2018 budget must support government institutions to give better services to the mining sector. As an example, a computerised mining title system, a mining cadastre is not operational as the Ministry of Mines allege that there are no adequate resources to roll out the programme. Melusi of MOFED disclosed that the Ministry of Mines and Mining Development included resources for the mining cadastre in their request to Treasury and the 2018 national budget will allocate the required resources.

- Sharing of the national generated between the national and local governments. The budget must meet the constitutional requirement to allocate at least 5% of national generated revenue to provincial and local governments in each fiscal year in line with Section 301 subsection (3). ZIMRA’s acting Commissioner General urged CSOs to work with local governments to ensure that public resources are channelled towards service delivery. Auditor General’s reports on local government have gory details of abuse of public resources available here. He agreed that the national budget must be aligned with the constitution.

- The national budget should earmark a portion of other public funds linked with mining like the Rural Electrification Levy (REL) to finance service delivery for communities where such resources are generated. Section 13 subsection 4 of the Constitution directs the state to innovate to ensure that communities benefit from resources in their areas. Miners are heavy contributors to the REL because they are huge consumers of electricity. In 2016, Blanket Mine paid REL amounting to $466,000. If 20% of the REL is ploughed back in Gwanda community, where Blanket Mine is located, it can contribute to improved rural electrification programme of Gwanda. The definition of Community Share Ownership Trusts (CSOTs) must be wider, to take advantage of the opportunities highlighted above. ZIMRA’s acting Commissioner General’s response was that CSOs should concentrate on pushing for beneficiation and value addition of minerals to ensure meaningful socio-economic benefits that can transform the lives of communities.

- Fiscal support should be given to the ASM sector on exploration costs to ensure sustainability and profitability of a sector key to earn the country much needed foreign currency. In addition, the ASM sector directly provides employment and income generation opportunities to 500,000 people. CSOs should work with the ASM sector on formalisation since government struggles to fund resources to the informal sector according to ZIMRA’s acting Commissioner General. Judith Kaulem of PFRT contributed that its government’s responsibility to ensure that the ASM sector is formalised. The Mines and Minerals Act does not recognise artisanal mining.

The breakfast meeting ended with the consensus that more formal and informal conversations are needed with the MOFED and ZIMRA to advance tax justice, to fight IFFs and to promote open data for public accountability. The facilitator, thanked the MOFED and ZIMRA for their time and contributions as well as other participants. Other future planned reflective conversation will be held focusing on ASM and the ease of doing business reforms: Exploring Opportunities to Empower Communities; Gender and Extractive: Women’s Bodies Violence and Extractivism; Natural Resources, Governance and Development; Towards Climate Justice in Zimbabwe; Business and Human Rights: BRICS Investments; Investing in Local Communities: Interrogating Community Benefit Schemes; and Competing Land Use in Zimbabwe: Conflicting Between Mining and Other Land Uses in Zimbabwe.